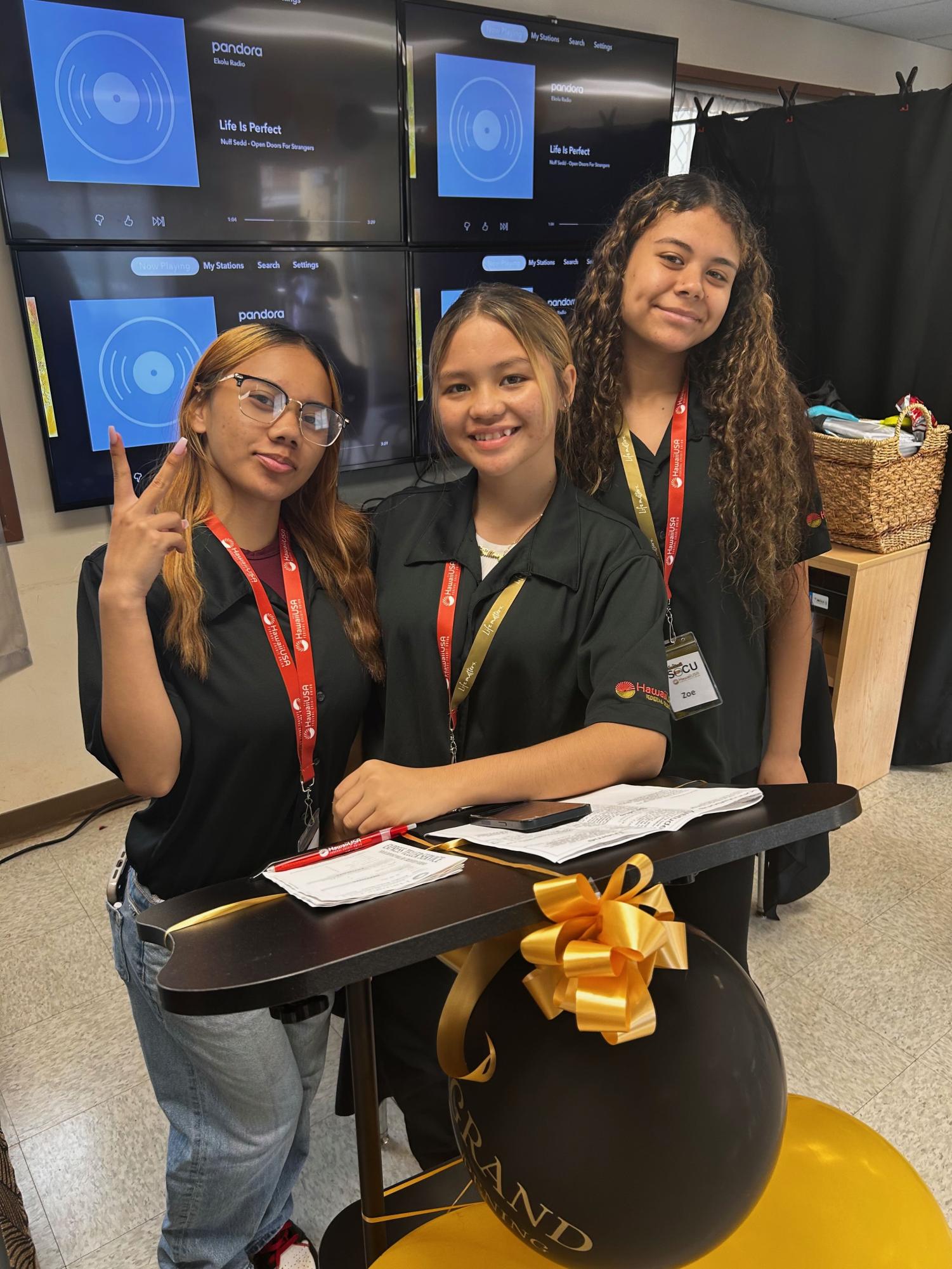

On November 13, 2024, NHIS had its grand opening of its Student Operated Credit Union (SOCU)

What is a Student Operated Credit Union? A Student Operated Credit Union is a financial institution run by students in partnership with another credit union. Our school has recently partnered with HawaiiUSA Federal Credit Union. SOCUs provide learning opportunities in financial management, customer service, and many other valuable skills.

Bryan Yococo of HawaiiUSA FCU explained, “The SOCU gives them an experience and lets them know how it feels to work in a financial institution.”

The SOCU is designed to encourage the importance of financial security within our school community.

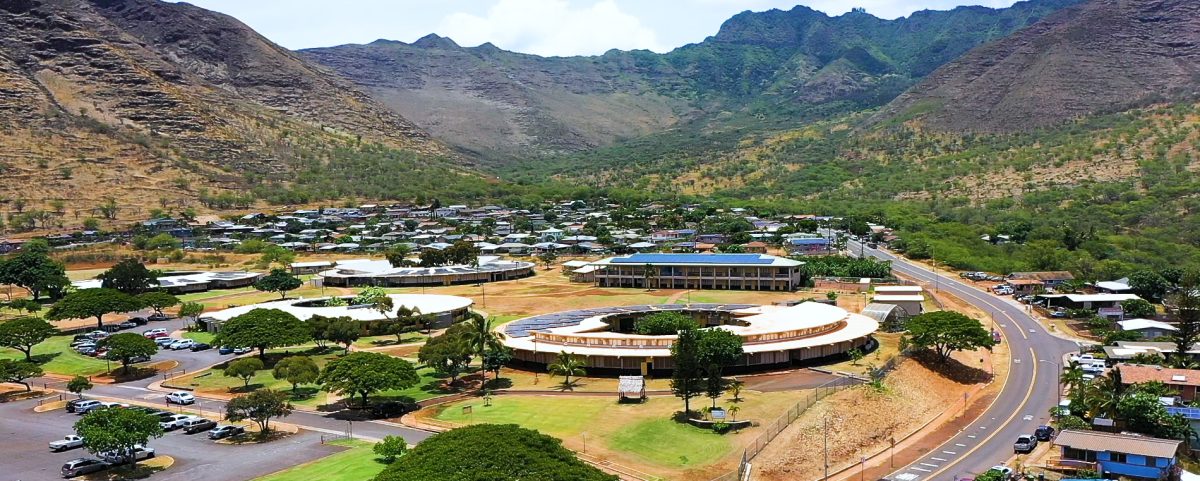

There are several other SOCUs around the state of Hawai’i, including schools like Waipahu High School and Pearl City High School.

Who are the students running this SOCU? The 3rd and 4th-year Business and Entrepreneurship Pathway students are the ones operating it. Teacher Keala Iaea helps students gain first-hand experience in running a business and handling financial operations—knowledge that is crucial in the world of business.

Mr. Yococo mentioned, “It’s always really reassuring to see that the schools are enthusiastic about having us come in, participate, share financial literacy, and practice saving money. The whole idea behind the SOCU is to have the kids practice saving money rather than spending it.”

Having this SOCU at our school helps our students and community build financial literacy, a point emphasized by several interviewees.

Pua Watson, NHIS Academy Director, said, “One of the goals of this initiative is to help our community and our families become more financially stable. We want to help students not only attain a college education but also purchase homes and remain here in Hawai’i.”

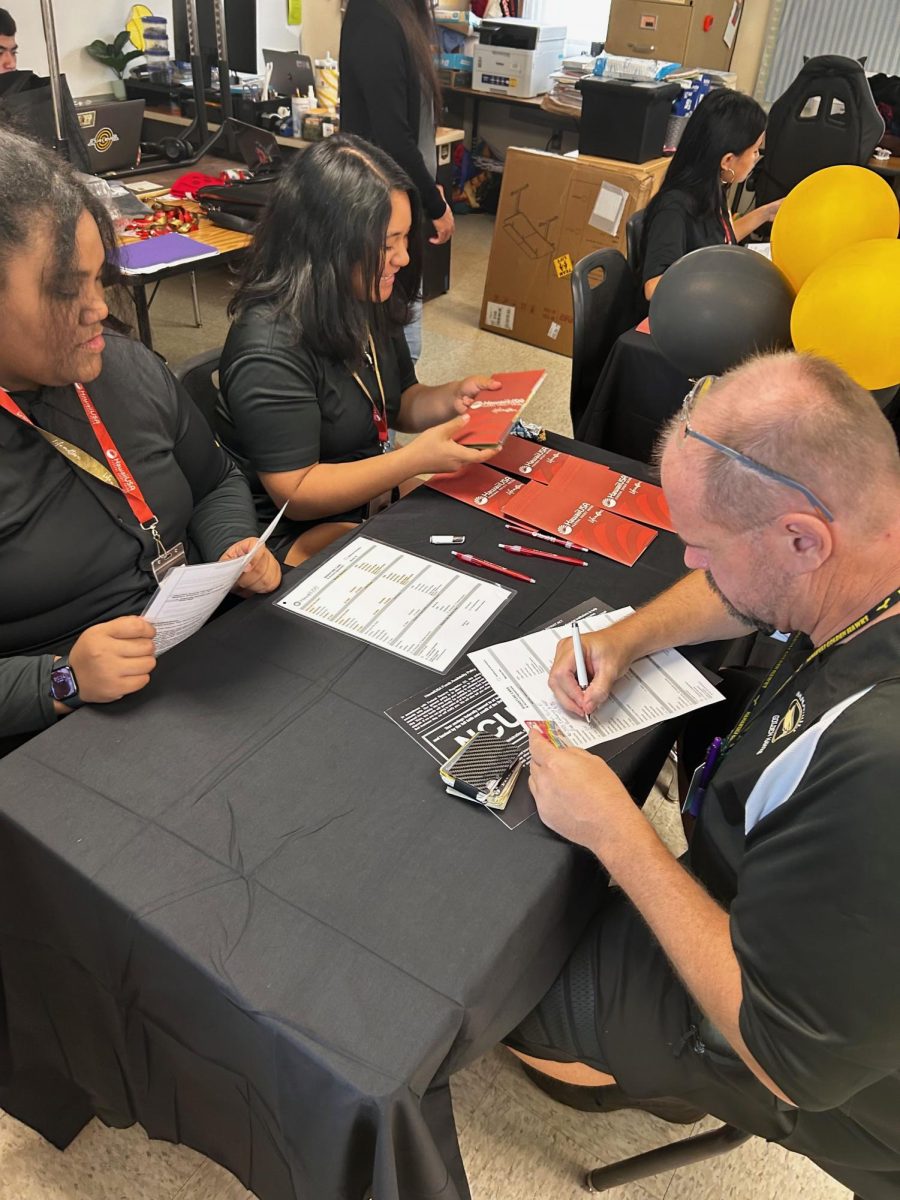

Teacher Todd Sibley said, “I really think this is a great opportunity for my students to practice financial management, which will lead to a better future for all.”

The students in the Business and Entrepreneurship Pathway apply skills they learn in the classroom to the SOCU.

Zoe Unga, junior, who works as a teller for the SOCU said, “I prepare by practicing how to use the ten-key.” A ten-key is a numeric keypad on a standalone calculator designed for quick data entry of numbers.

NHIS Principal Dr. Christine Udarbe-Valdez, also attended the grand opening. She even opened an account and made a deposit.

Udarbe-Valdez said, “I am so excited for our students. This opportunity is critical for financial literacy and for preparing them for life beyond high school. For our students to engage in this learning now and build skills will prepare them to leave us and be very successful. I’m so excited!”

Udarbe-Valdez said, “I am so excited for our students. This opportunity is critical for financial literacy and for preparing them for life beyond high school. For our students to engage in this learning now and build skills will prepare them to leave us and be very successful. I’m so excited!”

The NHIS SOCU will be open every Wednesday during lunch at P8 in Kumu Pua’s room. Don’t be shy—stop by, open a savings account, and start saving money. Even if you don’t open an account, come learn about financial literacy.